- Identifying the Need (Discovery)

- Sourcing the Supplier(s)

- Negotiating Terms, Contracts, SLAs and Service Descriptions

- Building and Maintaining Relationships

The procurement typically starts with the business identifying a need for a product or service. The process of identifying such a need may be for an existing product or service that simply needs to be reordered or the introduction of a new or transformed requirement. Depending on the type of need, multiple departments, projects and management teams could be involved.

Getting this step right is vital. This is what will build both the ‘Requirements Documentation’ for the tender and the ‘Service Description’ that will be the heart of the contract. The most basic question is “What do we want to buy?”, but it is sometimes far easier to say than to answer. Typical queries might be:

- What do we currently have?

- What, basically, is the outcome we want? (This is the ‘What?’, not the ‘How?’).

- How do we want the service to change over the term of the contract? Are we going to expect something different in 3 or 5 years time, and how do we build flexibility in now?

- Is there likely to be a change in scope during the lifetime of the contract?

- Where is the service going to be delivered from, and to what locations?

- What is the timescale for procurement activity, the transition and transformation activity, and the go-live schedules? What term of contract do we expect to sign?

We can support you in building this documentation, and making sure nothing important is missed out, that can come back to bite, or increase cost later.

Who is best placed to deliver what you need, and give the best value/outcome/cost-effectiveness?

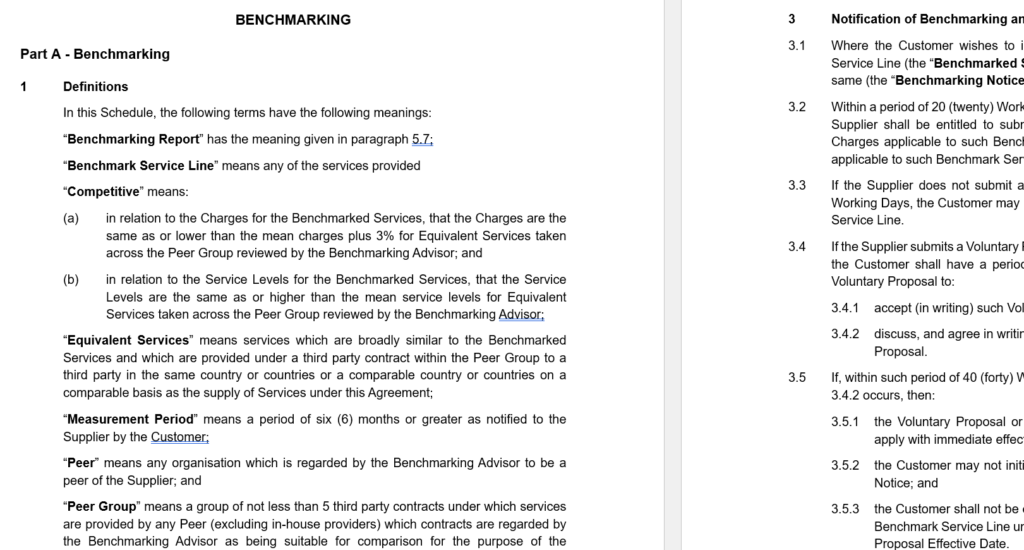

You may already know the company you want to use to deliver this service and are just seeking to confirm this, or benchmark the pricing, or you may be looking for a brand new way of working. Using Gartner and Forester, as well as Market Intelligence, we can support you in letting you know:.

- Who are the recognised leaders in this market?

- Who would be able to deliver the long term, as well as short term outcomes?

We will also help you with talking with and understand the reference sites that may have been provided, giving a selection of useful questions and helping dig to the truth.

Then we would support you in building the most appropriate proposals/tender documentation (RFI/RFS/RFP/RFQ). Included could be:

- What is the service to be delivered?

- Must Have (mandatory) requirements

- Should Have (we would expect these to be delivered as standard) requirements

- Could Have (it would be great if they did this) requirements

- Would Have (we would want this in the future, but not immediately) requirements

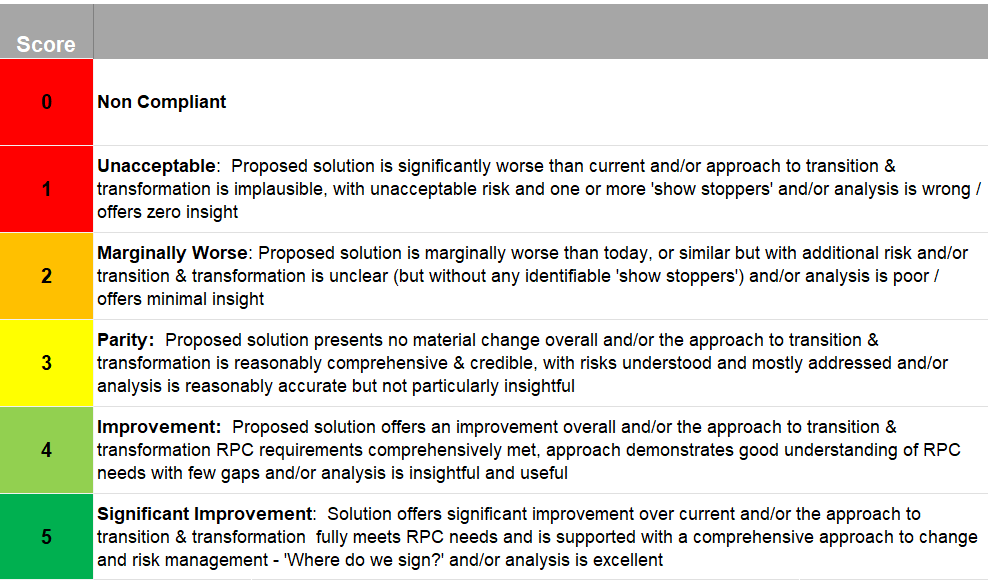

- What quality/SLAs/KPIs are appropriate? What does “good” look like?

- Are there any complications or difficulties that need to be stated up front?

- “As Now” -> “To Be” documentation (including technical background)

- In & Out of Scope areas are clearly stated (countries/technologies/opportunities etc.).

- Timescales

- Standard MSA (if available)

- Quality of Service (SLAs and KPIs expected)

- Governance and Reporting requirements

- Cost matrix to be completed (including fixed vs variable pricing and Transition and Transformation pricing)

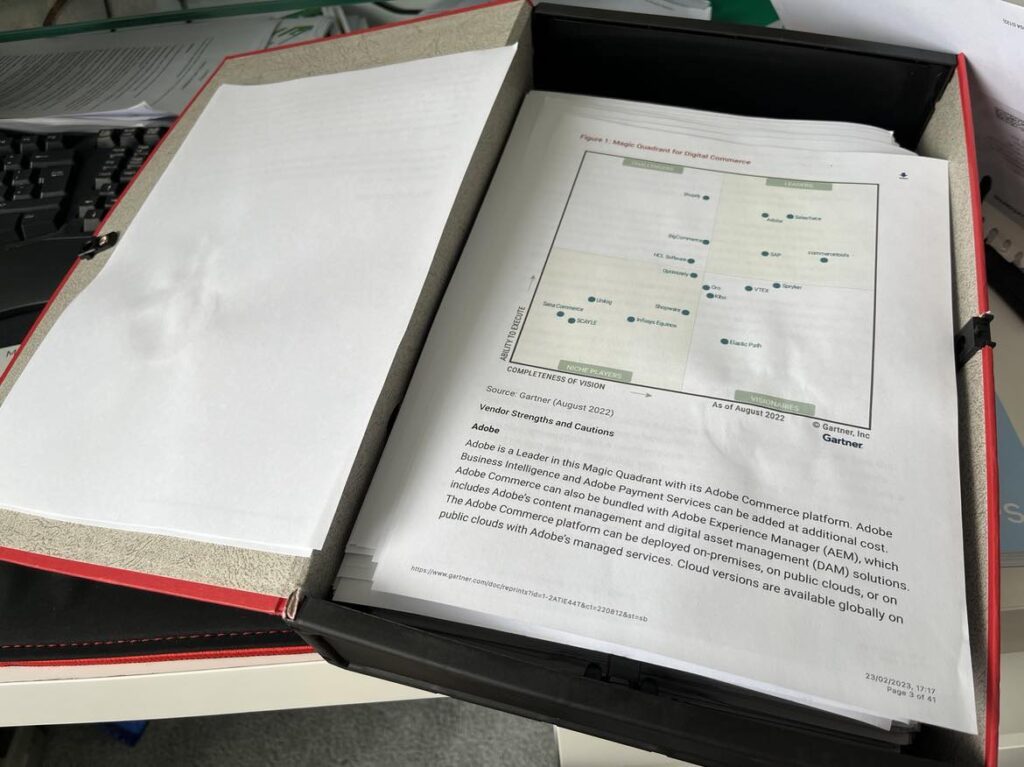

- Benchmarking requirements

- GDPR, HSSE, Intellectual Property, Risk and Compliance, and any other “Code of Conduct” type requirements

We will support you in taking the responses from the potential suppliers and, having built an evaluation matrix which weights and scores the importance of each element, we can support you in downselecting to the final 2, 3 or (in some cases) just 1 Supplier that can be taken on to the next stage, and into further detail, as we start to negotiate the art of the possible.

The technical workshops, MSA discussions, and Service Description fine-tuning all need to be brought together, concurrently, to create a single contract pack. This will lead us to the ‘Best and Final Offer’, and the final decision of who the preferred Supplier is to be.

The work does not stop there – all the detail needs to be included in the pack including understanding exactly how much is it going to cost, not just the per month, but the Total Cost of Ownership across the term. What are the risks of cost increases, as things change? Who owns the risk of service continuity and disaster recovery? What are the exit costs from current contracts? If TUPE and HR are involved, where are the risks? What would be the complications and costs (hard and soft) of transitioning and transforming the service?

Making sure all this is built-in, and understood clearly, stops arguments later. It is vital to make sure there are no gaps in service and ownership. Who “owns” and has responsibility for the end to end, with OLAs and P1/P2 management needs to be clearly laid out.

Checking every definition, all the dependencies, and every requirement is clearly understood, with no wriggle room, will mean the Customer will get what they want, and the Supplier will be able to price and deliver accordingly.

Building the payments schedule, alongside the transition programme, so that payments are made against agreed criteria and at accepted milestones, and also including scope options that may be required later, so the Supplier cannot add uplifts for small changes or additions as you are locked in is vital at this stage. On the other side, if the scope reduced, then how does the cost flex to mirror that?

Getting all this right up front will save a great deal of heartache later.

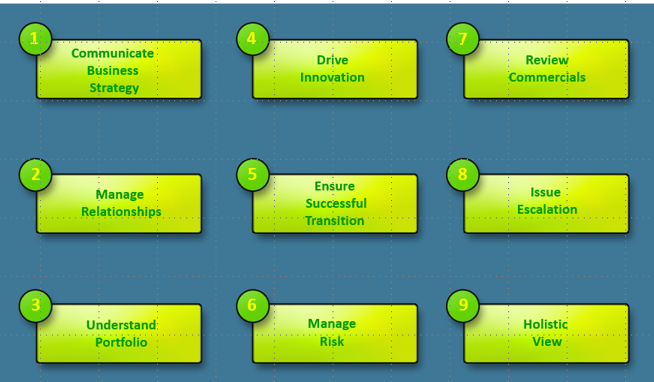

The work of managing a contract does not stop with the signature on the page. The Governance, Vendor and Supplier Management of the service will go on as long as the contract is in place.

Making sure it is clearly laid out at the beginning how this is to work, and who attends what meetings, how risks, issues and escalations are managed, and SLAs/KPIs are reported and dealt with will keep things on an even keel and, if we have built continuous improvement into the contract, things will get better and better. In a perfect world, if it is clearly understood what “good looks like” to the Supplier through the Governance structure and meetings, then the chances of resigning a new contract improve dramatically, and removes the costs of continually tendering these pieces of work.

Throughout this time the importance of analysing trends, evaluating and reporting on the outcomes (both quality of service and cost) means that any risks will be caught early, and can be dealt with before they become an issue.